Lessons I Learned From Info About How To Be Vat Registered

While any business can choose to register for vat, it’s only compulsory if your.

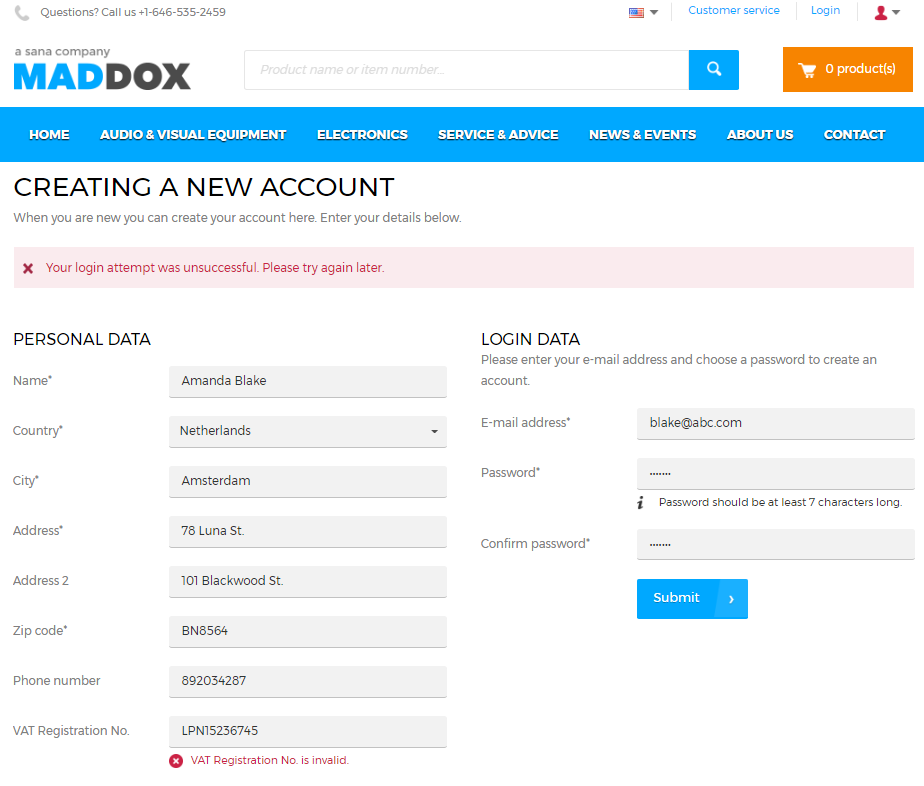

How to be vat registered. Select the relevant purchase order. To register vat on a purchase order. The person required to register for vat must file a.

Registering for vat can be done either by filling an online vat application form or by sending the form to hmrc by post. The majority of businesses register online through the hmrc website using their government gateway login. As part of the process, you will.

How to become vat registered. Should i become vat registered? Pay any vat due to hmrc.

Choose the icon, enter purchase order, and then choose the related link. If a business has not registered for vat, it will have no vat number or requirement to include this on the invoice. You must complete a vat registration form and submit supporting documents to the inland revenue division at the address below.

Registration provisions apply to any natural or legal person conducting business in the uae, even if the person has no trade licence. You must register for vat with hm revenue and customs (hmrc) if your business’ vat taxable turnover is more than £85,000 in a rolling 12 month. Threshold to join scheme threshold to leave scheme;

There are a few ways you can register for vat. Sole proprietors must fill in the form a. You’ll need to select ‘cancel vat registration’.