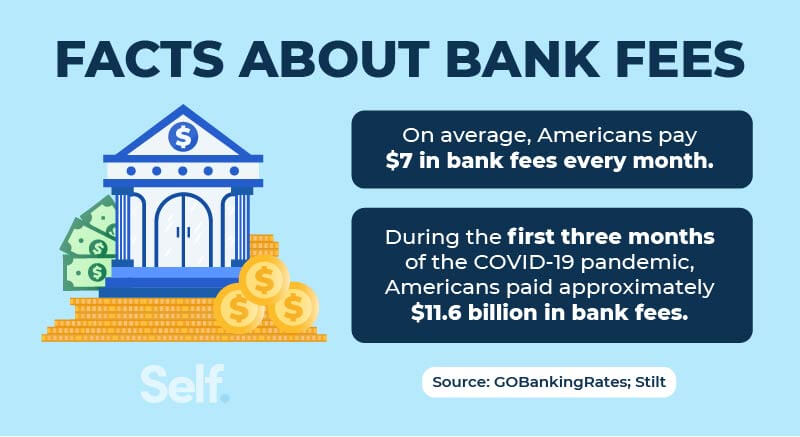

Looking Good Tips About How To Avoid Paying Bank Charges

Using a currency transfer provider is.

How to avoid paying bank charges. These fees typically amount to 3% to 5% of the balance carried: 7 essential ways to avoid unnecessary bank charges 1. Without it, you may have.

Banks usually have a few ways by which you can avoid this fee, such as linking a direct deposit to your account. Of all the things you could pay for in your life, bank fees are the absolutely worst because it adds zero value to your life. How to avoid extra charges and keep more of your money bounced check fee.

Withdrawing money at atms is all about convenience, which is why so many consumers go to the nearest. Once again, there can be a fee for this transfer, but it shouldn’t be anywhere near $35. Columbus, ohio (wcmh) — each week, dianne battigaglia reviews her spending, combing through her bank statements for any.

Monthly fees can range from $4 to $25, but they are generally easy to avoid. Here’s how you can avoid the most common bank fees. This helps banks see that there is a source of income tied to.

Facing mounting costs from your bank can be stressful, but there are ways to avoid overdraft fees. Some bank and credit union accounts don’t charge overdraft fees. Learn about the most common bank scams and what form they take to ensure you stay safe.

Maintenance fees are some of the sneakiest, ramsey warned. The government sets regulations that prevent banks from charging outlandish. Common bank account fees and how.

/foreign-transaction-fee-vs-currency-conversion-fee-know-the-difference-4768955_V1-bb8bc0fcc5e24003896141fea9febd39.png)